Investing Basics

As many people live longer lives, this means that you may need a larger amount of retirement savings than previous generations. And a key way to make sure you have enough is to start saving early. While putting aside a chunk of your paycheck may seem like something you might want to put off until later in life, the fact is that the earlier you start saving, the better off you’ll be when you’re getting ready to retire.

What most people don't realize is that every day you put off saving for retirement now, you increase the amount of money you will need to set aside from each paycheck in the future. Waiting a few years to start saving could have a significant impact on whether or not your savings will last throughout your retirement.

Why you need to start saving – and investing – for retirement right now…

Simply saving money in cash is not enough to build a functional retirement fund because inflation would erode the value of those savings over time. Investing your retirement funds, on the other hand, in assets like stocks and bonds can help your money beat the inflation rate and grow over time. The younger you are when you start contributing, the more time your money has to grow before you need it. Not only does starting early make a big difference in the end, but this difference could also be even greater if you set aside more money per month or get a larger rate of return on your investments.

How compound interest can make a BIG impact on your investments

This is the interest you earn on both your original deposit and on the interest you continue to accumulate over time. The effect of compound interest is especially seen over long periods helping your investment to grow faster.

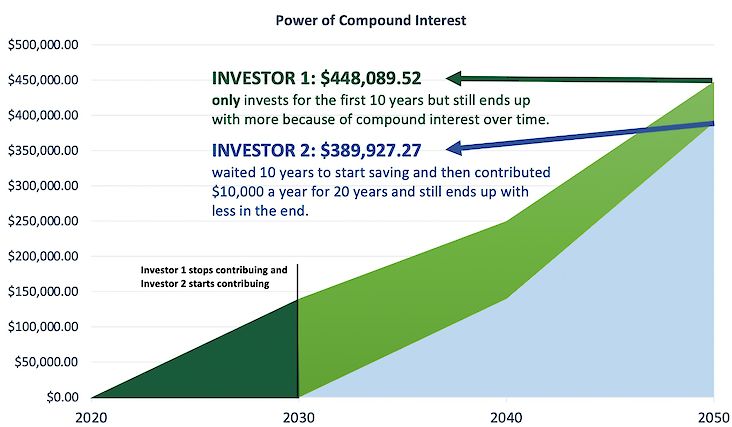

The following example illustrates why starting an investment plan early is so beneficial. The earlier you start, the longer you have for compound interest to grow!

Let’s look at a hypothetical scenario to break this down even further and show how compound interest can give your savings a big boost over time.

Investor 1: They start right away and invest $10,000 a year and earn 6% (interest) for 10 years, which gives them $139,716.43. They then stop contributing and still see their investment grow from compound interest for 20 more years. Their ending balance is $448,089.52.

Investor 2: They wait 10 years to get started and then and invest $10,000 a year and earn 6% (interest) for 20 years. They would only have $389,927.27 at the end even though they made contributions for twice as long as investor 1!

The longer your money is invested, the greater the impact compound interest will have on your returns.

The snowball effect of compounding makes early investing, particularly in a retirement account due to the tax benefits that much more enticing since the earlier you start investing, the more compounded returns you can hope to make. Additionally, the more you contribute to your retirement plan, the better; try to contribute the maximum amount each year so your principal may generate the most return possible.

In addition to starting as early as possible and harnessing the power of compounding interest, here are some other things to consider as you think about your retirement plan:

- PENSION – If you have one, learn more about what options are available to you.

- 401(k)/403(b) – Start contributing pre-tax today.

- EMPLOYER MATCH – If this benefit is available to you, take advantage of it! Don’t leave money on the table.

- SOCIAL SECURITY – Find out what your estimated payments will be and what strategies you can put into place to maximize your benefit.

What is the risk of not investing?

Not investing early, putting aside enough, or saving at all places a huge burden of responsibility on your future self. You may even think that Social Security will be enough to get you through your retirement, but for many people Social Security benefits are not enough to cover living expenses, not to mention medical care or emergency expenses.

Statistics show that the average retiree spends about $46,000 per year on living expenses, and $4,300 per year out-of-pocket for health care expenses.[1] When you take in to consideration that the average Social Security recipient collects just under $16,956 a year in benefits, you simply cannot afford not to invest in your future now.[2]

EFS Advisors will help you get started, no matter your stage in life or your financial situation. Our goal is to meet you where you are today and make plans to get you to where you want to be tomorrow. CONTACT US today to schedule a retirement review and to gain control over your financial future.

FIND YOUR LOCAL ADVISOR

[1] https://www.marketwatch.com/story/now-the-bad-news-and-slightly-less-horrible-news-about-saving-for-retirement-2018-03-07

[2] https://money.usnews.com/money/retirement/social-security/articles/how-much-you-will-get-from-social-security