Budgeting to Achieve Your Goals

Do you really know how much you spend and save?

Budgeting is the process of creating a plan to spend your money. This spending plan is called a budget, and helps you balance your expenses with your income. A budget allows you to determine in advance if you will have enough money to do the things you need to do or would like to do.

Why is Budgeting So Important?

Budgeting is the foundation of every strong financial plan. Think of your money like driving a car: If we didn’t have signs, we wouldn’t know when or where to turn, stop, go, or exit. Without signs, you’d feel lost as a driver. Budgeting is the signal system that gives your money direction. As you spend, you have more control over where your money goes because you can follow the signs.

Many people don’t realize they spend more than they make, and when expenses are greater than your income, you have a problem. Since budgeting tells your money where to go, it helps ensure that you will have enough money to pay for necessities like housing, food, and utilities, as well as things you want, like a vacation or a new car. Following a budget will also keep you out of debt or help you work your way out of it.

Budgeting and Your Financial Plan

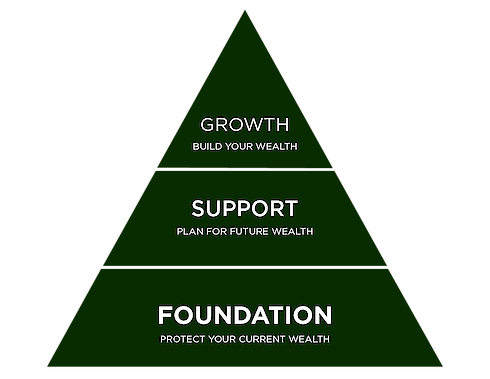

The first priority of a sound financial plan is protecting your current wealth. Budgeting is a key part of that security, making sure that your money is going where it’s supposed to go. Budgeting will also help you in the other main parts of a financial plan: planning for your future wealth and then building your wealth. When you create a financial plan, budgeting will help you define your goals, make and follow a budget, set up an emergency fund, and pay off debt.

In addition to keeping your spending on track, a good budget can uncover cash flow problems, and free up money you could put toward other financial goals. However, if you're trying to save some money, having specific goals to work toward maintains your momentum. When you envision a financial plan, you’ll identify attainable, realistic goals for the short- and long-term and use them to create a functional budget.

Following through with spending and savings goals can be difficult, as they require long-term commitment, and, in some instances, changes to your behavior and lifestyle. But when you use budgeting as a tool for your financial goals, you’ll have reassurance that those changes are worth it.

Where to Begin

The idea of budgeting and managing your wealth can be overwhelming. At EFS Advisors, we’re here to help. With a budget plan comes peace of mind and a clear picture of how much you can save and invest each month. We will work with you to help answer the following questions:

- How do I start building a budget?

- Do I need an emergency fund?

- How do I know if I am spending too much, or not saving enough?

- What should I include in my budget?

- How much should I save each month?

- How often will I review my budget?

It’s important to remember that financial planning works best when you take an ongoing, active role in maintaining it. The worst time to stop budgeting is when you’ve just gotten your finances under control! EFS Advisors will be the partner you need to stay the course, ensuring you don’t slide back into old habits. Even if you have plenty of money to meet your expenses, budgeting is still an essential part of managing your personal finances. The commitment you make to budgeting has a significant impact on you and your loved ones now and for generations to come.

EFS Advisors will be there, no matter your stage in life or your financial situation. Contact us to get started on your path to succeeding in your personal finance goals.

https://www.thebalance.com/personal-finance-budget-4802696

https://www.thebalancemoney.com/how-to-make-a-budget-1289587